Condo Insurance in and around Tinley Park

Get your Tinley Park condo insured right here!

Condo insurance that helps you check all the boxes

Welcome Home, Condo Owners

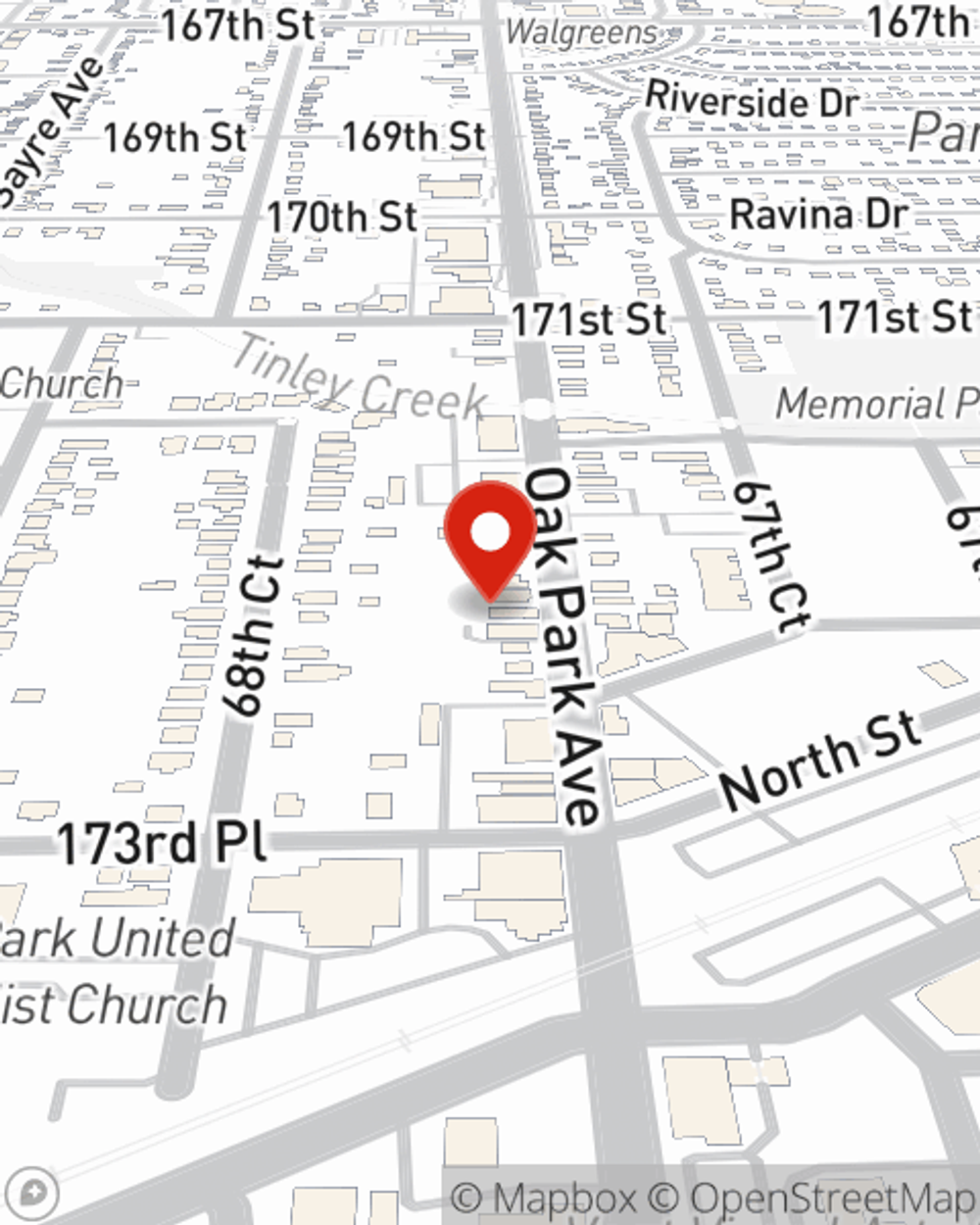

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Tinley Park. Sorting through coverage options and providers is a lot to deal with. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Tinley Park enjoy unbelievable value and no-nonsense service by working with State Farm Agent Jim Fuentes. That’s because Jim Fuentes can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as musical instruments, sports equipment, electronics, cameras, and more!

Get your Tinley Park condo insured right here!

Condo insurance that helps you check all the boxes

Protect Your Home Sweet Home

Everyone knows having condominium unitowners insurance is essential in case of a ice storm, blizzard or windstorm. Sufficient condo unitowners insurance ensures that your condo can be rebuilt, so you aren’t left with the bill for a home that isn’t habitable. Another helpful thing about condo unitowners insurance is its ability to protect you in certain legal situations. If someone has an accident because of negligence on your part, you could be held responsible for their lost wages or physical therapy. With enough condo coverage, you have liability protection in the event of a covered claim.

As a commited provider of condo unitowners insurance in Tinley Park, IL, State Farm helps you keep your home protected. Call State Farm agent Jim Fuentes today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Jim at (708) 532-3045 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Jim Fuentes

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.